What if? Forecasting price effects in retail

You can use TimeGPT to forecast a set of timeseries, for example the demand of a product in retail. But what if you want to evaluate different pricing scenarios for that product? Performing such a scenario analysis can help you better understand how pricing affects product demand and can aid in decision making.

In this example, we will show you: * How you can use TimeGPT to forecast product demand using price as an exogenous variable * How you can evaluate different pricing scenarios that affect product demand

1. Import packages

First, we import the required packages and initialize the Nixtla client.

import pandas as pd

import os

from nixtla import NixtlaClient

from datasetsforecast.m5 import M5

nixtla_client = NixtlaClient(

# defaults to os.environ.get("NIXTLA_API_KEY")

api_key = 'my_api_key_provided_by_nixtla'

)

Use an Azure AI endpoint

To use an Azure AI endpoint, remember to set also the

base_urlargument:

nixtla_client = NixtlaClient(base_url="you azure ai endpoint", api_key="your api_key")

2. Load M5 data

Let’s see an example on predicting sales of products of the M5 dataset. The M5 dataset contains daily product demand (sales) for 10 retail stores in the US.

First, we load the data using datasetsforecast. This returns:

Y_df, containing the sales (ycolumn), for each unique product (unique_idcolumn) at every timestamp (dscolumn).X_df, containing additional relevant information for each unique product (unique_idcolumn) at every timestamp (dscolumn).

Tip

You can find a tutorial on including exogenous variables in your forecast with TimeGPT here.

Y_df, X_df, S_df = M5.load(directory=os.getcwd())

Y_df.head(10)

100%|██████████| 50.2M/50.2M [00:00<00:00, 58.1MiB/s]

INFO:datasetsforecast.utils:Successfully downloaded m5.zip, 50219189, bytes.

INFO:datasetsforecast.utils:Decompressing zip file...

INFO:datasetsforecast.utils:Successfully decompressed c:\Users\ospra\OneDrive\Nixtla\Repositories\nixtla\m5\datasets\m5.zip

c:\Users\ospra\miniconda3\envs\nixtla\lib\site-packages\datasetsforecast\m5.py:143: FutureWarning: The default of observed=False is deprecated and will be changed to True in a future version of pandas. Pass observed=False to retain current behavior or observed=True to adopt the future default and silence this warning.

keep_mask = long.groupby('id')['y'].transform(first_nz_mask, engine='numba')

| unique_id | ds | y | |

|---|---|---|---|

| 0 | FOODS_1_001_CA_1 | 2011-01-29 | 3.0 |

| 1 | FOODS_1_001_CA_1 | 2011-01-30 | 0.0 |

| 2 | FOODS_1_001_CA_1 | 2011-01-31 | 0.0 |

| 3 | FOODS_1_001_CA_1 | 2011-02-01 | 1.0 |

| 4 | FOODS_1_001_CA_1 | 2011-02-02 | 4.0 |

| 5 | FOODS_1_001_CA_1 | 2011-02-03 | 2.0 |

| 6 | FOODS_1_001_CA_1 | 2011-02-04 | 0.0 |

| 7 | FOODS_1_001_CA_1 | 2011-02-05 | 2.0 |

| 8 | FOODS_1_001_CA_1 | 2011-02-06 | 0.0 |

| 9 | FOODS_1_001_CA_1 | 2011-02-07 | 0.0 |

For this example, we will only keep the additional relevant information from the column sell_price. This column shows the selling price of the product, and we expect demand to fluctuate given a different selling price.

X_df = X_df[['unique_id', 'ds', 'sell_price']]

X_df.head(10)

| unique_id | ds | sell_price | |

|---|---|---|---|

| 0 | FOODS_1_001_CA_1 | 2011-01-29 | 2.0 |

| 1 | FOODS_1_001_CA_1 | 2011-01-30 | 2.0 |

| 2 | FOODS_1_001_CA_1 | 2011-01-31 | 2.0 |

| 3 | FOODS_1_001_CA_1 | 2011-02-01 | 2.0 |

| 4 | FOODS_1_001_CA_1 | 2011-02-02 | 2.0 |

| 5 | FOODS_1_001_CA_1 | 2011-02-03 | 2.0 |

| 6 | FOODS_1_001_CA_1 | 2011-02-04 | 2.0 |

| 7 | FOODS_1_001_CA_1 | 2011-02-05 | 2.0 |

| 8 | FOODS_1_001_CA_1 | 2011-02-06 | 2.0 |

| 9 | FOODS_1_001_CA_1 | 2011-02-07 | 2.0 |

3. Forecasting demand using price as an exogenous variable

We will forecast the demand for a single product only, for all 10 retail stores in the dataset. We choose a food product with many price changes identified by FOODS_1_129_.

products = [

'FOODS_1_129_CA_1',

'FOODS_1_129_CA_2',

'FOODS_1_129_CA_3',

'FOODS_1_129_CA_4',

'FOODS_1_129_TX_1',

'FOODS_1_129_TX_2',

'FOODS_1_129_TX_3',

'FOODS_1_129_WI_1',

'FOODS_1_129_WI_2',

'FOODS_1_129_WI_3'

]

Y_df_product = Y_df.query('unique_id in @products')

X_df_product = X_df.query('unique_id in @products')

We merge our two dataframes to create the dataset to be used in TimeGPT.

df = Y_df_product.merge(X_df_product)

df.head(10)

| unique_id | ds | y | sell_price | |

|---|---|---|---|---|

| 0 | FOODS_1_129_CA_1 | 2011-02-01 | 1.0 | 6.22 |

| 1 | FOODS_1_129_CA_1 | 2011-02-02 | 0.0 | 6.22 |

| 2 | FOODS_1_129_CA_1 | 2011-02-03 | 0.0 | 6.22 |

| 3 | FOODS_1_129_CA_1 | 2011-02-04 | 0.0 | 6.22 |

| 4 | FOODS_1_129_CA_1 | 2011-02-05 | 1.0 | 6.22 |

| 5 | FOODS_1_129_CA_1 | 2011-02-06 | 0.0 | 6.22 |

| 6 | FOODS_1_129_CA_1 | 2011-02-07 | 0.0 | 6.22 |

| 7 | FOODS_1_129_CA_1 | 2011-02-08 | 0.0 | 6.22 |

| 8 | FOODS_1_129_CA_1 | 2011-02-09 | 0.0 | 6.22 |

| 9 | FOODS_1_129_CA_1 | 2011-02-10 | 3.0 | 6.22 |

Let’s investigate how the demand - our target y - of these products has evolved in the last year of data. We see that in the California stores (with a CA_ suffix), the product has sold intermittently, whereas in the other regions (TX and WY) sales where less intermittent. Note that the plot only shows 8 (out of 10) stores.

nixtla_client.plot(df,

unique_ids=products,

max_insample_length=365)

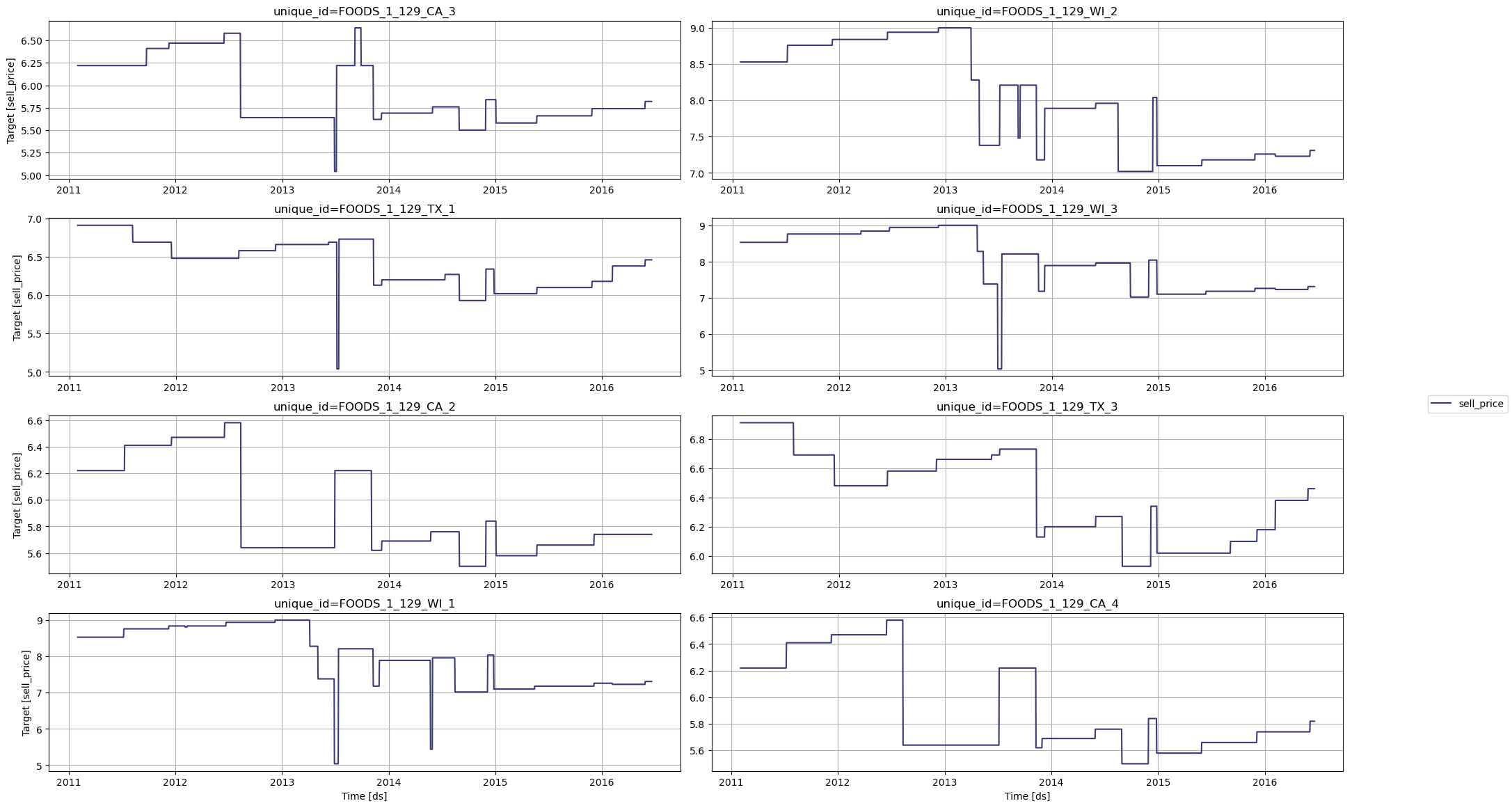

Next, we look at the sell_price of these products across the entire data available. We find that there have been relatively few price changes - about 20 in total - over the period 2011 - 2016. Note that the plot only shows 8 (out of 10) stores.

nixtla_client.plot(df,

unique_ids=products,

target_col='sell_price')

Let’s turn to our forecasting task. We will forecast the last 28 days in the dataset.

To use the sell_price exogenous variable in TimeGPT, we have to add it as future values. Therefore, we create a future values dataframe, that contains the unique_id, the timestamp ds, and sell_price.

future_ex_vars_df = df.drop(columns = ['y'])

future_ex_vars_df = future_ex_vars_df.query("ds >= '2016-05-23'")

future_ex_vars_df.head(10)

| unique_id | ds | sell_price | |

|---|---|---|---|

| 1938 | FOODS_1_129_CA_1 | 2016-05-23 | 5.74 |

| 1939 | FOODS_1_129_CA_1 | 2016-05-24 | 5.74 |

| 1940 | FOODS_1_129_CA_1 | 2016-05-25 | 5.74 |

| 1941 | FOODS_1_129_CA_1 | 2016-05-26 | 5.74 |

| 1942 | FOODS_1_129_CA_1 | 2016-05-27 | 5.74 |

| 1943 | FOODS_1_129_CA_1 | 2016-05-28 | 5.74 |

| 1944 | FOODS_1_129_CA_1 | 2016-05-29 | 5.74 |

| 1945 | FOODS_1_129_CA_1 | 2016-05-30 | 5.74 |

| 1946 | FOODS_1_129_CA_1 | 2016-05-31 | 5.74 |

| 1947 | FOODS_1_129_CA_1 | 2016-06-01 | 5.74 |

Next, we limit our input dataframe to all but the 28 forecast days:

df_train = df.query("ds < '2016-05-23'")

df_train.tail(10)

| unique_id | ds | y | sell_price | |

|---|---|---|---|---|

| 19640 | FOODS_1_129_WI_3 | 2016-05-13 | 3.0 | 7.23 |

| 19641 | FOODS_1_129_WI_3 | 2016-05-14 | 1.0 | 7.23 |

| 19642 | FOODS_1_129_WI_3 | 2016-05-15 | 2.0 | 7.23 |

| 19643 | FOODS_1_129_WI_3 | 2016-05-16 | 3.0 | 7.23 |

| 19644 | FOODS_1_129_WI_3 | 2016-05-17 | 1.0 | 7.23 |

| 19645 | FOODS_1_129_WI_3 | 2016-05-18 | 2.0 | 7.23 |

| 19646 | FOODS_1_129_WI_3 | 2016-05-19 | 3.0 | 7.23 |

| 19647 | FOODS_1_129_WI_3 | 2016-05-20 | 1.0 | 7.23 |

| 19648 | FOODS_1_129_WI_3 | 2016-05-21 | 0.0 | 7.23 |

| 19649 | FOODS_1_129_WI_3 | 2016-05-22 | 0.0 | 7.23 |

Let’s call the forecast method of TimeGPT:

timegpt_fcst_df = nixtla_client.forecast(df=df_train, X_df=future_ex_vars_df, h=28)

timegpt_fcst_df.head()

INFO:nixtla.nixtla_client:Validating inputs...

INFO:nixtla.nixtla_client:Preprocessing dataframes...

INFO:nixtla.nixtla_client:Inferred freq: D

WARNING:nixtla.nixtla_client:The specified horizon "h" exceeds the model horizon. This may lead to less accurate forecasts. Please consider using a smaller horizon.

INFO:nixtla.nixtla_client:Using the following exogenous variables: sell_price

INFO:nixtla.nixtla_client:Calling Forecast Endpoint...

| unique_id | ds | TimeGPT | |

|---|---|---|---|

| 0 | FOODS_1_129_CA_1 | 2016-05-23 | 0.875594 |

| 1 | FOODS_1_129_CA_1 | 2016-05-24 | 0.777731 |

| 2 | FOODS_1_129_CA_1 | 2016-05-25 | 0.786871 |

| 3 | FOODS_1_129_CA_1 | 2016-05-26 | 0.828223 |

| 4 | FOODS_1_129_CA_1 | 2016-05-27 | 0.791228 |

Available models in Azure AI

If you are using an Azure AI endpoint, please be sure to set

model="azureai":

nixtla_client.forecast(..., model="azureai")For the public API, we support two models:

timegpt-1andtimegpt-1-long-horizon.By default,

timegpt-1is used. Please see this tutorial on how and when to usetimegpt-1-long-horizon.

We plot the forecast, the actuals and the last 28 days before the forecast period:

nixtla_client.plot(

df[['unique_id', 'ds', 'y']],

timegpt_fcst_df,

max_insample_length=56,

)

4. What if? Varying price when forecasting demand

What happens when we change the price of the products in our forecast period? Let’s see how our forecast changes when we increase and decrease the sell_price by 5%.

price_change = 0.05

# Plus

future_ex_vars_df_plus= future_ex_vars_df.copy()

future_ex_vars_df_plus["sell_price"] = future_ex_vars_df_plus["sell_price"] * (1 + price_change)

# Minus

future_ex_vars_df_minus = future_ex_vars_df.copy()

future_ex_vars_df_minus["sell_price"] = future_ex_vars_df_minus["sell_price"] * (1 - price_change)

Let’s create a new set of forecasts with TimeGPT.

timegpt_fcst_df_plus = nixtla_client.forecast(df=df_train, X_df=future_ex_vars_df_plus, h=28)

timegpt_fcst_df_minus = nixtla_client.forecast(df=df_train, X_df=future_ex_vars_df_minus, h=28)

INFO:nixtla.nixtla_client:Validating inputs...

INFO:nixtla.nixtla_client:Preprocessing dataframes...

INFO:nixtla.nixtla_client:Inferred freq: D

WARNING:nixtla.nixtla_client:The specified horizon "h" exceeds the model horizon. This may lead to less accurate forecasts. Please consider using a smaller horizon.

INFO:nixtla.nixtla_client:Using the following exogenous variables: sell_price

INFO:nixtla.nixtla_client:Calling Forecast Endpoint...

INFO:nixtla.nixtla_client:Validating inputs...

INFO:nixtla.nixtla_client:Preprocessing dataframes...

INFO:nixtla.nixtla_client:Inferred freq: D

WARNING:nixtla.nixtla_client:The specified horizon "h" exceeds the model horizon. This may lead to less accurate forecasts. Please consider using a smaller horizon.

INFO:nixtla.nixtla_client:Using the following exogenous variables: sell_price

INFO:nixtla.nixtla_client:Calling Forecast Endpoint...

Available models in Azure AI

If you are using an Azure AI endpoint, please be sure to set

model="azureai":

nixtla_client.forecast(..., model="azureai")For the public API, we support two models:

timegpt-1andtimegpt-1-long-horizon.By default,

timegpt-1is used. Please see this tutorial on how and when to usetimegpt-1-long-horizon.

Let’s combine our three forecasts. We see that - as we expect - demand is expected to slightly increase (decrease) if we reduce (increase) the price. In other words, a cheaper product leads to higher sales and vice versa.

Note

Price elasticity is a measure of how sensitive the (product) demand is to a change in price. Read more about it here.

timegpt_fcst_df_plus = timegpt_fcst_df_plus.rename(columns={'TimeGPT':f'TimeGPT-sell_price_plus_{price_change * 100:.0f}%'})

timegpt_fcst_df_minus = timegpt_fcst_df_minus.rename(columns={'TimeGPT':f'TimeGPT-sell_price_minus_{price_change * 100:.0f}%'})

timegpt_fcst_df = pd.concat([timegpt_fcst_df,

timegpt_fcst_df_plus[f'TimeGPT-sell_price_plus_{price_change * 100:.0f}%'],

timegpt_fcst_df_minus[f'TimeGPT-sell_price_minus_{price_change * 100:.0f}%']], axis=1)

timegpt_fcst_df.head(10)

| unique_id | ds | TimeGPT | TimeGPT-sell_price_plus_5% | TimeGPT-sell_price_minus_5% | |

|---|---|---|---|---|---|

| 0 | FOODS_1_129_CA_1 | 2016-05-23 | 0.875594 | 0.847006 | 1.370029 |

| 1 | FOODS_1_129_CA_1 | 2016-05-24 | 0.777731 | 0.749142 | 1.272166 |

| 2 | FOODS_1_129_CA_1 | 2016-05-25 | 0.786871 | 0.758283 | 1.281306 |

| 3 | FOODS_1_129_CA_1 | 2016-05-26 | 0.828223 | 0.799635 | 1.322658 |

| 4 | FOODS_1_129_CA_1 | 2016-05-27 | 0.791228 | 0.762640 | 1.285663 |

| 5 | FOODS_1_129_CA_1 | 2016-05-28 | 0.819133 | 0.790545 | 1.313568 |

| 6 | FOODS_1_129_CA_1 | 2016-05-29 | 0.839992 | 0.811404 | 1.334427 |

| 7 | FOODS_1_129_CA_1 | 2016-05-30 | 0.843070 | 0.814481 | 1.337505 |

| 8 | FOODS_1_129_CA_1 | 2016-05-31 | 0.833089 | 0.804500 | 1.327524 |

| 9 | FOODS_1_129_CA_1 | 2016-06-01 | 0.855032 | 0.826443 | 1.349467 |

Finally, let’s plot the forecasts for our different pricing scenarios, showing how TimeGPT forecasts a different demand when the price of a set of products is changed. In the graphs we can see that for specific products for certain periods the discount increases expected demand, while during other periods and for other products, price change has a smaller effect on total demand.

nixtla_client.plot(

df[['unique_id', 'ds', 'y']],

timegpt_fcst_df,

max_insample_length=56,

)

In this example, we have shown you: * How you can use TimeGPT to forecast product demand using price as an exogenous variable * How you can evaluate different pricing scenarios that affect product demand

Important

- This method assumes that historical demand and price behaviour is predictive of future demand, and omits other factors affecting demand. To include these other factors, use additional exogenous variables that provide the model with more context about the factors influencing demand.

- This method is sensitive to unmodelled events that affect the demand, such as sudden market shifts. To include those, use additional exogenous variables indicating such sudden shifts if they have been observed in the past too.

Updated 28 days ago